In a single day, the crypto market has experienced significant volatility as trading dynamics have influenced price actions. On Monday, the price of Bitcoin dropped by 3.8% from its total market cap, resulting in a loss of $60 billion, with liquidations totaling $630 million. While drastic downturns are common in the crypto market, the market experienced one of the highest drawdowns of this year.

As monetary policies shift to favor risk-on assets, it’s crucial to understand how Bitcoin and the crypto market may evolve after periods of high volatility.

Rate cuts not enough to ease volatility

Despite the U.S. Federal Reserve reducing borrowing costs by 25 basis points, the market hasn’t moved as traders expected, as such major events typically trigger rallies that would lead to an altcoin season.

The altcoin season index had reached 100 on Monday, only to drop below the 70 threshold, showing sideways movement. The instant spike could have been attributed to a glitch and short movements of lower-traded altcoins, as the market was rather muted.

However, the opposite occurred: on Friday, September 19th, $4.3 billion in BTC and ETH options expired, resulting in significant market pressure. Over $3.5 billion in Bitcoin options expired with a maximum pain of $114,000, while $806 million in Ethereum options expired with a maximum pain price of $4,500.

The market slid even further than anticipated, with Bitcoin dropping by 2.4% and nearing the $111,000 mark, triggering $1.8 billion in liquidations. At the same time, Ethereum fell by almost 8%, reaching a low of $4,150.

Large-scale options expirations typically heighten market volatility as investors adjust their positions. September 26th marks a critical event, with $18 billion in notional value set to expire—the largest such expiration ever recorded.

Multi-faced market drawdown

The current market volatility isn’t only driven by options expiring, but also stems from several other factors that have kept Bitcoin and crypto market prices low. Regulatory pushback always affects the market, and regulatory pressure continues to loom over it as the SEC issued new guidelines on September 21st, which create compliance checks for digital assets. This, in turn, could affect anticipated ETFs for VC-backed altcoins such as XRP or SOL.

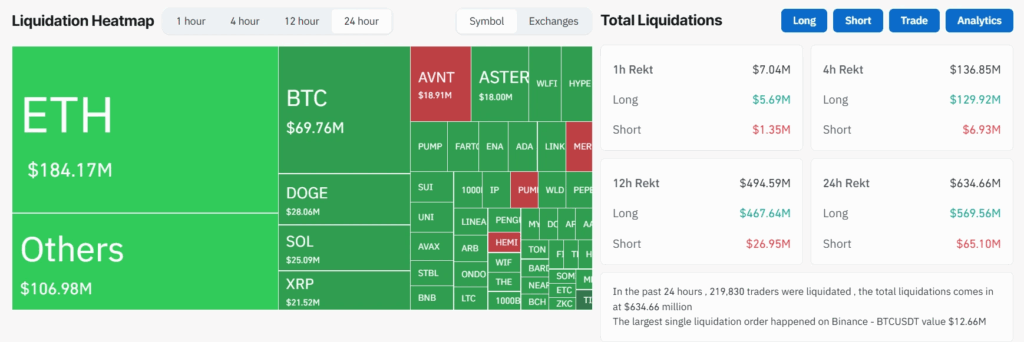

Significant leverage contributed to the amplified losses during the recent price drops. CoinGlass data indicated that leveraged positions were responsible for a considerable portion of the $630 million in liquidations. A total of 370,000 accounts were liquidated in a single day, highlighting the amount of over-leveraged trading in the current market.

Furthermore, a widespread weakness across the altcoin market has exacerbated the situation. Major altcoins have experienced sharp declines, with Ethereum leading the liquidations. Other prominent altcoins such as XRP, Cardano (ADA), and Chainlink (LINK) also suffered significant losses. This broad-based altcoin weakness has ultimately prompted a flight to safety, compelling investors to reconsider their positions.

The rise of Bitcoin dominance

As markets opened red on Monday, investors looked to rotate capital. As Bitcoin only dropped by 3.7%, altcoins suffered higher losses, ranging from 7% to 10%. As a result, data from Coinglass shows Bitcoin dominance has risen again by 1% to 57% post trading.

Such events are common during periods of high volatility. Investors also look to stablecoins to avoid further impermanent losses if the market continues to decline. Analysts are eyeing a $99,000 level in the post-September 26th period, which could be a necessary correction following six months of bullish price action, during which the Total Market Cap nearly doubled. The overall cryptocurrency market has grown from its low of $2.5 trillion on April 8th to $4.2 trillion, with Bitcoin reaching an all-time high.

As it currently stands, the Altcoin Season Index, which measures market sentiment, currently stands at 67/100, indicating that while there is still interest in altcoins, a partial rotation back to Bitcoin is underway. Until confidence returns to the broader market, a much-anticipated altcoin season, fueled by the Fed’s rate cuts, seems unlikely.

Looking ahead

Even amid market volatility, investors remain optimistic, as Q4 typically brings a potential recovery. Historically, October is often considered crypto’s strongest month, referred to as Uptober, when the market sees significant gains across the board.

Analysts see the macro outlook as positive. New monetary policy outcomes could lead to Jerome Powell announcing additional rate cuts, which would boost investor confidence. Even without additional rate cuts currently announced, institutional investors continue to add Bitcoin to their balance sheets.

Even amidst the market volatility, signs of long-term adoption continue to emerge. For example, the state of Michigan is considering a proposal to create a state-level crypto reserve, signaling growing institutional interest.

While these developments are promising for the long term, the immediate future remains uncertain. The market is in a delicate position, and investors should proceed with caution.

Navigate the market with confidence

Navigating crypto’s price swings and market cycles can be challenging, even for experienced traders. The current downturn highlights the inherent volatility of the asset class and the difficulty of timing the market. If you want to access the crypto market’s potential without the stress of active trading, Yieldfund offers investment plans with yearly returns of up to 48% and weekly payouts directly to users’ USDC wallets.

Start exploring how Yieldfund can help build your crypto portfolio.