The crypto market now totals over 50 million cryptocurrencies across multiple blockchains and networks. As the blockchain industry grows past 2026 due to increased regulation, the number of unique crypto tokens is expected to grow with adoption.

We will break down the current state of the cryptocurrency market, exploring the number of tokens in the world, where they can be traded, and how they have evolved from 2019 to 2026.

How many cryptocurrencies are there

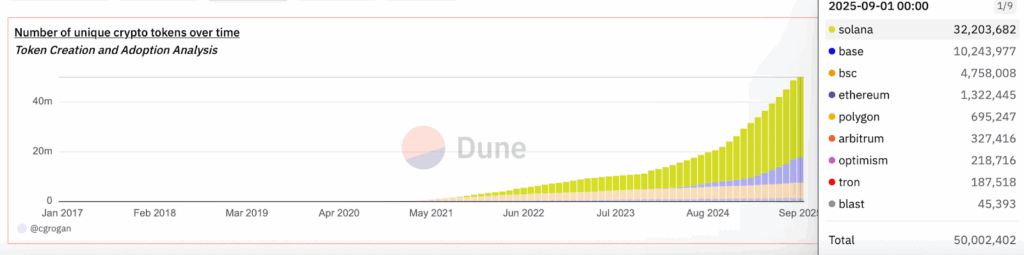

There are exactly 50,002,402 cryptocurrencies in the entire blockchain ecosystem consisting of more than one network, according to data from Dune Analytics. This number tracks smart contracts that have been created and have shown trading activity on one or more occasions.

The number of cryptocurrencies varies per blockchain and network, and from the roughly 50 million tokens currently available, 32 million have been launched on the Solana network. Other blockchains, such as Base or Binance Smart Chain, are also part of the top 3.

What are cryptocurrencies

A cryptocurrency is a decentralized digital or virtual token that isn’t issued or controlled by centralized institutions and is secured through cryptography. Cryptocurrencies are decentralized assets that use a blockchain network of multiple validators to secure transactions and validate that a transaction and wallet have performed an action – sending or holding the asset.

All tokens now in circulation are considered cryptocurrencies, with Bitcoin being the first, launched in 2009. Since then, the market has evolved to other crypto assets named “altcoins” that provide utility such as voting rights, represent the value of 1 USD on the blockchain, or more.

How many cryptocurrencies are there in the world

As of 2026, there are over 50 million different cryptocurrencies in existence, and this number shows how quickly cryptocurrencies have evolved since they were first introduced. To put this growth into perspective, we analyzed the number of tokens across a longer timeline. In 2013, an estimated 50 cryptocurrencies existed. In 2019, the number of cryptocurrencies on smart contracts was 85,000, while today there are millions of tokens.

While there are numerous cryptocurrencies, not all of them are active, and they are not all created equal.

Active vs. inactive tokens

The active and inactive number of cryptocurrencies tells a lot about the state of the crypto market. Our analysis reveals that only 10,385 active cryptocurrencies exist, while the remaining 49 million tokens exhibit lower activity, suggesting that people have either lost interest or are inactive.

Inactive cryptocurrencies are projects that people have abandoned and aren’t traded. They are typically taken off cryptocurrency exchanges and have limited liquidity. For many, these tokens are higher risks since they have no real value.

From the total amount, Solana accounts for 64% of all tokens, out of which more of them are, as some refer to, “dead tokens.” In contrast, active cryptocurrencies have active trading volume; they are used across the blockchain ecosystem. As we explored and witnessed, an active cryptocurrency often has an engaged community – but that’s not always the case.

How many cryptocurrencies have failed

As we explored on-chain data, between 44% and 46% of smart contracts are inactive. Some data shows that around 10,000 tokens have failed; however, in reality, the number is much higher. Additional research shows that over 50% of all cryptocurrencies listed on platforms such as CoinGecko have already failed.

Some of the main reasons why cryptocurrencies fail include:

- Abandoned Projects: Developers cease working on the project due to a lack of funding or interest.

- Scams: Many tokens are created as part of “pump-and-dump” schemes or other fraudulent activities.

- Low Trading Volume: A lack of investor interest leads to minimal trading, making the token illiquid and effectively useless.

- Product Market Fit: Many cryptocurrencies have failed due to poor marketing and an inability to gain traction due to a lack of market fit.

Why are there so many cryptocurrencies

The increased number of cryptocurrencies is because launching a crypto token has become easier with platforms like Pump Fun or similar ones. Additionally, blockchains like Solana or Binance Smart Chain make it easier, with some programming knowledge, to create and launch their own tokens.

As we found, the increased number of cryptocurrencies is due to their purpose. As the market grows, cryptocurrencies gain more utility in the ecosystem, while others exist solely for their own sake. Utility tokens provide value for users in the ecosystem (to pay for fees), stablecoins make it easier for institutions to transact, while meme coins are highly speculative assets that belong in crypto culture. The sheer variety of tokens offers a wide range of investment opportunities but also introduces complexity and risk.

Where are cryptocurrencies traded

Cryptocurrencies are bought and sold typically on cryptocurrency exchanges. However, there is a big difference in the cryptocurrencies available on centralized versus decentralized exchanges. Total spot trading volume on a CEX has reached $3.9 trillion and continues to grow.

On the other side of the spectrum are DEXs, which are decentralized exchanges where users trade peer-to-peer. In Q2 of 2025, volume was $877 billion, which shows there’s still demand for DEX trades. It’s crucial to understand that cryptocurrencies that are not listed on Binance, Coinbase, or OKX remain accessible, attracting significant volume and generating demand.

Navigating the crypto market

For European investors, the vast number of cryptocurrencies presents both opportunities and challenges. While the potential for high returns is a significant draw, the risk associated with unproven or volatile assets cannot be ignored. Professional quantitative trading companies like Yieldfund provide an alternative, offering expert-managed exposure to the crypto market with minimal prior knowledge required.

If you want to find out more about the Yieldfund and get exposure to the vast cryptocurrency market, explore our platform to see how we can help you achieve your financial goals.

FAQ

How many cryptocurrencies are there in the world?

As of January 2026, there are over 50 million cryptocurrencies. However, only about 10,000 of these are actively traded and hold significant value.

How many cryptocurrencies can you trade on Coinbase?

As of 2026, Coinbase, one of the world’s largest crypto exchanges, lists approximately 319 cryptocurrencies. They tend to list more established projects after a thorough vetting process.