For the first time since June, Bitcoin dropped below $100,000, potentially signaling a shift in market sentiment after months and years of sustained growth. While Bitcoin peaked at $128,000 in 2025, the external factors that previously drove crypto markets to new highs are now cooling, prompting traders to reassess their positions and recalibrate their outlooks.

What factors are driving this decline? Several key elements include macroeconomic shifts, a potential shift in the narrative, and the possible conclusion of a market cycle. Understanding these dynamics is crucial for investors aiming to navigate the current landscape and prepare for future opportunities.

Market selloff

Let’s first understand what already happened. Global markets, including crypto specifically, experienced volatility following President Trump’s tariff announcements. As we discussed in our earlier article on the $19 billion liquidation event, the market drop wasn’t caused by tariffs but by a structural shift in the market cycle. This shift continues to ripple across the market, with Bitcoin dropping below $100,000 for the first time since June 2025.

The market saw additional liquidations as Bitcoin hovered at $104,000. Data suggests that over $2.1 billion in leveraged positions are being liquidated in 24 hours. Additionally, CoinGlass data shows a wall forming in the $105,000 price region, acting as price resistance and flipping previous support levels.

Bitcoin, despite its maturation as an asset, remains vulnerable to these broader market forces when uncertainty peaks. Additionally, profit-taking after strong gains earlier in 2025 has intensified. With that, analysts are reassessing their bullish year-end prediction, lowering it from $185,000 to $120,000. What’s apparent is that traders are locking in profits.

COT positioning

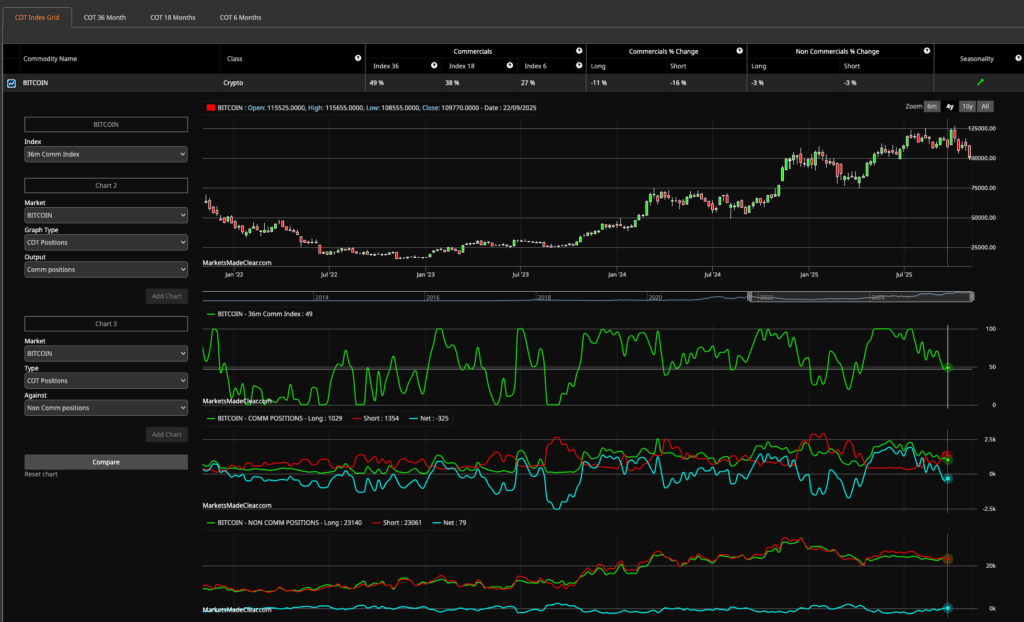

One piece of data supports the correction: the Commitment of Traders (COT) indicator. The indicator reveals divergence between institutional and retail participants, with commercial traders having maintained their short hedging even into November. They currently hold 1,029 long contracts vs. 1,354 short contracts, resulting in a net position of -325.

By contrast, retail traders (non-commercial) remain long with over 32,140 long contracts vs 23,061 short contracts. This creates a setup in which institutions protect their positions while retail remains optimistic, diverging from market direction: professional participants anticipate revisions while retail continues to chase new highs.

What stands out isn’t aggressive directional betting, but rather reduced overall participation. Commercial long exposure fell 11% while short exposure dropped 16%, pointing to cautious sentiment rather than outright bearishness.

Macro uncertainty

Beyond on-chain data and technicalities, macroeconomic conditions are heavily weighing on risk-on assets. The anticipated rate cuts, which decreased interest rates by another 25 basis points, led to further downside. Markets reacted strongly to Fed Powell’s uncertainty about future December rate cuts, triggering a brief risk-off rotation.

Wintermute points out the problem isn’t liquidity; it’s where liquidity is allocated. As highlighted previously, demand for Bitcoin dropped at its all-time high, similar to gold. Investors are less inclined to buy overpriced assets, despite their “digital gold” status. Many wait on the sidelines.

Current market sentiment creates headwinds for Bitcoin and similar risk assets, heightened by broken support levels and anticipation of a possible reversal.

On-chain data flows

On-chain metrics provide additional context to the price action. Exchange inflows have increased as holders move Bitcoin from cold storage to trading platforms, typically a precursor to selling activity. Long-term holder supply has stabilized after reaching record levels earlier in the year. This cohort, which typically provides price support during corrections, hasn’t shown signs of panic selling.

Institutional flows through Bitcoin ETFs have also moderated. After record inflows in the first half of 2023, recent weeks have seen neutral to slightly negative flows. This shift reflects the broader risk-off sentiment affecting traditional finance channels in crypto markets.

Scenario outlook

Looking ahead, several scenarios could unfold as Bitcoin and investors await more confirmation of future movements. One case we previously highlighted involves the market entering a downward trend. Jesse Simons, interim CTO at Yieldfund, emphasized that “structurally, BTC looks ready to carve out a lower high on the longer time frame.”

Another argument is that Bitcoin has ended its 5th Elliott Wave and could now enter a downtrend. In a bullish scenario, however, for the short term, with central bank guidance and renewed institutional inflow, Bitcoin could be back at $110,000 – only to further reiterate our thesis of more downside in the future. The bearish case involves deeper corrections if macro conditions deteriorate further. A break below $90,000 would likely trigger technical selling and test the $80,000 support zone. However, at those levels, long-term accumulation typically resumes as value investors step in.

Markets rarely move in straight lines. The current pullback below $100,000, while psychologically significant, represents a natural correction after substantial gains. Whether this marks a temporary pause or the beginning of deeper consolidation will depend on how quickly uncertainties resolve and whether institutional appetite for crypto returns.