Budgeting as a couple starts with an itemised list of what you share and what you keep separate. A joint budget shouldc cover household items such as rent or mortgage, utilities, groceries, insurance, debt service, transport, and childcare. Define personal allowances so each partner has an agreed amount for discretionary spending; treating allowances as explicit line items preserves autonomy and reduces friction.

- What a joint budget must cover

- How to split income and expenses: pick the fair method

- Build the budget step-by-step and fill in a template

- Examples for low, mid, and high-income couples

- Track, automate, and choose the right apps

- Communication rules, check-ins, and conflict resolution

- Build a budget together

What a joint budget must cover

Start with a clear list of every shared expense, naming predictable fixed and variable household costs. Common categories include rent or mortgage, utilities and internet, groceries and household supplies, insurance and debt service, transport, and childcare.

Inventory every income source and account: paychecks, side gigs, savings, credit lines, and investment accounts, plus who controls each login. Record net monthly income and recurring outflows in an app that becomes your single source of truth.

Translate those values into measurable goals: an emergency fund target, a monthly savings rate, short-term priorities, and investing targets. Those goals determine the reporting fields your couple’s budget template needs and keep conversations focused on outcomes.

How to split income and expenses: pick the fair method

Simple and transparent: a 50/50 split removes negotiation and keeps payments predictable. For example, if shared expenses total €1,200 per month, each partner pays €600. Use this method when incomes are similar or when you prioritise administrative simplicity over precise equity.

Fair by capacity: a proportional split follows one clear formula: partner share = household expense × (individual net income ÷ household net income). For example, with €1,200 of household expenses and net incomes of €3,000 and €1,500, Partner A pays €800 and Partner B pays €400. This aligns contributions with the ability to pay but requires income transparency and a cadence for updates when pay changes.

Best of both worlds: combine a joint account for core bills with separate accounts for personal spending and fixed allowances. Direct rent, mortgage, utilities, and childcare from the joint account while leaving subscriptions and leisure on individual accounts, or assign specific bills and adjust top-ups either 50/50 or proportionally. That hybrid model keeps daily life simple while preserving independence.

Build the budget step-by-step and fill in a template

Assign every euro to a category, a sinking fund, or a personal allowance until income minus allocations equals zero. This forces decisions about discretionary room and prevents surprise spending by showing both partners exactly where money goes each month.

It’s equally important to set monthly sinking funds for irregular costs such as car repairs, taxes, holidays, and gifts, and to choose an emergency fund target of 3 to 6 months of essential expenses.

To be successful, start with a small emergency buffer, then direct extra cash to high-priority debt using a snowball method while keeping incremental savings flowing. If incomes differ, use proportional contributions so each partner pays in line with capacity. For practical guidance on how to start saving for summer vacation, use a dedicated fund.

Finally, create a fillable budget template and complete the following fields: net income, joint fixed costs, variable spend categories, monthly transfers to savings, and each partner’s personal allowance. For example, with €4,000 net: rent €1,200, groceries €400, utilities €150, transfers to sinking funds €300, and personal €200; the row should show how allocations sum to income. Use the template to keep conversations numerical and focused on trade-offs rather than assumptions.

Examples for low, mid, and high-income couples

For a couple with combined net income of €2,200 per month, allocate roughly 40% to housing (€880), 18% to groceries (€396), 10% to transport (€220), 6% to utilities (€132), 3% to a small emergency contribution (€66) and 5% to modest savings (€110). The remaining 18% covers personal and discretionary needs. Quick wins include a subscription audit, switching to different groceries, and adapting to transportation needs.

For a €5,000 net household, aim for 20% savings (€1,000), housing about 30% (€1,500), groceries and essentials 20% (€1,000), sinking funds 5% (€250), and discretionary 10% (€500), with the remainder for utilities, transport, and childcare. A proportional split lets both partners keep fair discretionary money while maintaining the 20% target. Couples’ budgeting apps make these adjustments accessible for everyone and also easy to understand.

With €12,000 net as a couple, after essentials and a 20% savings rate, you could end up with €4,000 of investable surplus. Couples can look for reliable weekly income streams that have capital working for them instead of losing it to inflation. One example could be 50% invested, 30% to mortgage debt paydown, and 20% to lifestyle.

Track, automate, and choose the right apps

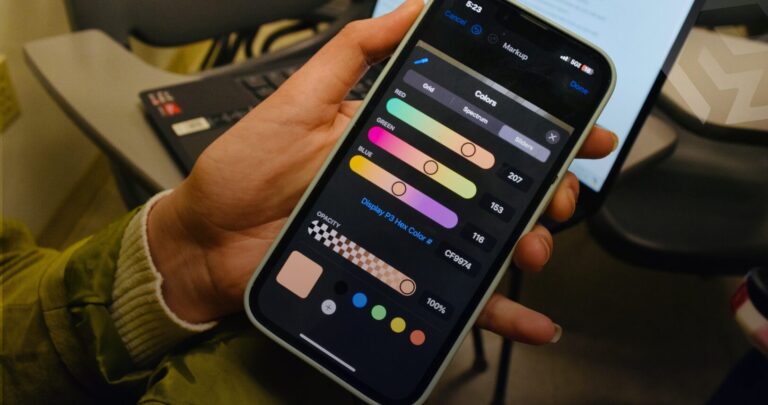

It’s important to select tools that support both joint and individual needs, such as financial applications that offer greater flexibility and shared transaction tagging. Dashboards provide a broader overview of all spending and savings. Using in-app investing is also useful, as couples can automate and maintain a clear overview without switching platforms.

For payments and regular spending, neobanks available in the Netherlands, such as Revolut or Bunq, offer joint accounts. Some make it easier even to invest. At the same time, local banks like ING and ABN began adapting to make it easier to save and spend as a couple.

If you want to invest extra capital, Yieldfund offers investment plans starting at €10,000 with weekly payouts in stablecoins and yields of up to 48% per year.

For a broader set of saving ideas and templates, see our Best budget ideas 2026 guide, then export or sync summaries into your preferred app.

Communication rules, check-ins, and conflict resolution

Communication is important in relationships, and this should also cover the financial part. Start the month with an overview of the previous one, to check goal progress and agree on two practical adjustments for the coming month: budget, saving rate, and large expenses.

The goal of the meeting is to have an overview of what happened and what’s ahead. These discussions can change as priorities shift, new goals are added, or when couples are planning bigger life changes, such as a child, moving, or purchasing property.

It’s important to make the meeting effective without conflict and use the time to note down each expense for the period, at least for the three months, and see if couples can budget.

Build a budget together

Couples need to be independent and also collaborate. Building a budget together helps reduce future discussions and keeps couples aligned even when there is uncertainty. Each couple should prioritize housing, existential expenses, and investments to ensure a better future for themselves.

In the end, it’s not about the right plan; it’s about what works. Splitting budgets, having a common or independent savings account, or working together on a plan. The goal is to be in sync and work together towards a common goal.th.