When trading crypto or other financial products, it’s always important to implement strategies that are well-defined and are suitable for the opportunity. Trading strategies are predefined plans that track indicators in trading to make informed decisions, providing a framework for setting clear entry and exit points and managing risk effectively.

The article covers everything from trends and momentum to the nuances and tools required for risk management.

- Trading strategies are predefined plans to trade stocks, crypto, or other assets

- With different trading strategies, the goal is the same: to generate profit

- Successful trading strategies take into account analysis and tools to execute trades

What are trading strategies

Trading strategies are systematic plans that rely on rules and market or asset analysis to guide trading decisions. They are used when buying or selling assets on the stock market or the crypto market. A trading strategy is a set of rules that traders use to dictate when to enter a trade, how to manage their position, and when to take profits or manage risks.

These strategies can be short-term or long-term, spanning from hours to weeks and even months. By following a systematic rule book, these strategies provide predictable outcomes based on analysis, which are crucial for navigating volatility while also managing risk.

Distinguishing trading strategies and styles

Trading strategies typically differ from trading styles. A trading style refers to a person’s risk level, as well as the frequency at which positions are left open and how often they are traded. Day trading is a type of trading style where users enter multiple trades every day and don’t follow long-term strategies.

On the other hand, a trading strategy refers to the methodology and approach used when trading markets to achieve profitability. Simply put, it’s the “how” behind each trade and what they are looking for when trading. One example is a trend trader, which uses indicators such as moving average crossovers as one indicator to signal buying and selling opportunities.

Trading strategies can be applied to multiple trading styles, but the type of indicator used can vary, as day traders often employ both long and short positions in combination with other indicators.

Why are trading strategies necessary

A trading strategy is necessary because it helps investors navigate markets successfully and profitably. Understanding market dynamics helps keep investors in check, while also mitigating emotional impulses such as FOMO or panic selling. This promotes calculated and objective actions using predefined rules.

Knowing how a trading strategy works and how it can be implemented helps traders program and implement automation tools like trading algorithms that rely on quantitative trading models. This provides higher precision and accountability for users, allowing them to focus on other aspects of the market while the algorithm executes trades with greater accuracy.

This approach is crucial for informed decision-making, ensuring that choices are based on data analysis rather than fleeting market sentiment, thereby preventing cycles of chasing quick profits or incurring significant losses. What’s more is that a clear strategy is the bedrock of effective risk management, explicitly outlining capital allocation, stop-loss placements, and profit targets. It helps protect capital and enables consistency, allowing traders to analyze performance and refine their approach.

Components of a trading strategy

Strategies rely on key elements that work together to guide trading decisions and help traders manage investments effectively.

Risk tolerance

Risk tolerance indicates how much users are willing to accept a loss on a trade and how much they are willing to allow their portfolio to fluctuate. Every trader should have a risk management plan that emphasizes setting stop-loss orders and never adjusting them. This differentiates successful from non-successful traders. Also, it should indicate how much leverage they are willing to use where potential profits and losses are magnified.

Technical analysis

Technical analysis is a cornerstone of executing the trade successfully. This involves utilizing charts and technical indicators, such as RSI and MACD, to identify patterns and forecast future price movements. Without a strong grasp and understanding of technical analysis, any strategy becomes flawed.

Trading tools

The right tools can significantly enhance the effectiveness of your strategy. These range from advanced charting platforms with a suite of technical indicators to automated trading software that can execute trades on your behalf. For strategies like breakout trading, placing a limit-entry order around key support or resistance levels can automate trade execution once the price breaks out, ensuring you don’t miss an opportunity.

Types of trading strategies

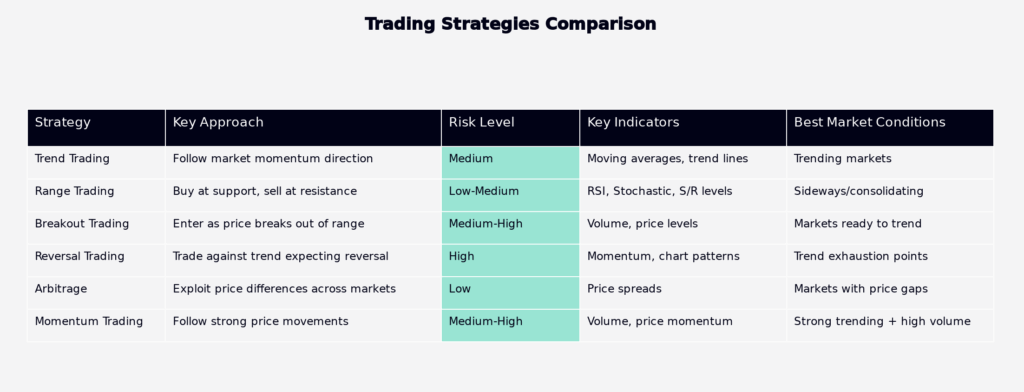

Several trading strategies can be implemented, but having the right one depends, as we previously mentioned, on the type of style. Here are some examples of trading strategies.

Trend trading

Trend trading identifies the direction of market momentum and aim to hold a long position (buying) in an uptrend or a short position (selling) in a downtrend. This approach is well-suited for position or swing traders, as positions can remain open as long as the trend continues.

Range trading

Range trading is used when the market is consolidating between key support and resistance levels, meaning its price is moving between clear lines. The strategy involves buying at the support level and selling at the resistance level. Traders often use oscillators, such as the Stochastic or RSI, to identify overbought and oversold conditions within a range.

Breakout trading

A breakout strategy aims to enter a trend as early as possible, right as the price “breaks out” of its established trading range. The aim is to catch the beginning of a new trend, and traders use volume spikes as a crucial indicator for breakout traders. They are also using candles to identify when volume is pushing the price higher and to confirm the strength of the breakout.

Reversal trading

In reversal trading, traders look for signs of trend exhaustion, such as weakening momentum or specific chart patterns, to anticipate a reversal in the trend. It’s a higher-risk strategy because it involves trading against the prevailing trend, and it’s important to distinguish a true reversal from a temporary price retracement.

Arbitrage

Arbitrage is a low-risk strategy that involves profiting from small price differences for the same asset across different markets. For example, a trader might buy a cryptocurrency on one exchange where it’s priced lower and simultaneously sell it on another exchange where it’s priced higher. The profit is the difference between the two prices, minus transaction fees.

Momentum trading

Momentum trading is based on the idea that assets that have been performing well will likely continue to do so, while those performing poorly will likely continue to decline. Traders identify assets with strong price movements and high volume and ride the momentum until signs of reversal appear. It’s a fast-paced strategy that requires active monitoring.

Considerations for successful trading strategies

Understanding how to trade and knowing what trading strategy fits your trading style requires years of studying the market, taking losses, and learning from the experience. Whether traders are following trends, trading within a range, or executing complex algorithmic trades, a well-defined plan sets users ahead of everyone else.

For investors seeking exposure to the crypto market without the steep learning curve of mastering these strategies, Yieldfund, a quantitative trading company, utilizes high-frequency trading to trade the Top 10 cryptocurrencies on the market. Yieldfund offers investment plans that allow investors to benefit from market movements and earn consistent returns of up to 48% per year, without requiring them to trade themselves.

FAQ

Why do trading strategies stop working?

They stop working because the market changes and the trading hypothesis changes. This is why it’s important to set stop losses when the strategy is invalidated.

What are trading strategies and principles?

A trading strategy is a systematic plan with predefined rules for buying and selling assets. Key principles include disciplined risk management, clear entry and exit criteria, and aligning the strategy with your risk tolerance and trading style.

What trading strategies can be automated?

Most strategies can be automated using algorithms. Trend-following, mean-reversion, arbitrage, and momentum strategies are commonly automated using algorithmic trading.