Altcoin season is the period during a cryptocurrency market cycle when capital rotates from Bitcoin to other cryptocurrencies like altcoins. As Bitcoin’s dominance fluctuates and capital begins to rotate towards new tokens, “alt season” could be around the corner in 2025.

In this guide, we cover everything about altcoin season, how to identify it, how to use data to drive your decisions, and how to invest in altcoins even when we’re not in an altcoin season.

- Altcoin season starts when altcoins like Ethereum, Solana, and others in the Top 50 outperform Bitcoin

- Bitcoin season is when Bitcoin outperforms the market

- A decline in Bitcoin dominance,below 54% indicates the start of altcoin season.

- Capital moves from Bitcoin to large caps, mid caps, and small caps before ending.

What is altcoin season

Altcoin season, or commonly referred to as alt season, is a period when altcoins are significantly outperforming Bitcoin, in terms of day-to-day market share. During an altcoin season, Bitcoin’s market dominance continues to decrease as investors look for new investment opportunities in the crypto market.

During an altcoin season, investors often see dramatic price increases across several cryptocurrencies. As Bitcoin’s dominance falls, capital flows from Bitcoin into smaller-cap altcoins, creating a cascading effect of price appreciation across the altcoin market.

What are altcoins

Altcoins are cryptocurrencies other than Bitcoin, which create the remaining market share of the crypto market. In some cases, institutional investors don’t label Ethereum as an altcoin. An altcoin differs from Bitcoin by having additional features, including smart contracts, a distinct validator system, and, in some cases, a higher token supply.

An altcoin typically has a smaller market capitalization than Bitcoin and is often compared in its price to Bitcoin. When investors’ sentiment shifts toward risk-taking and growth potential, altcoins become attractive alternatives.

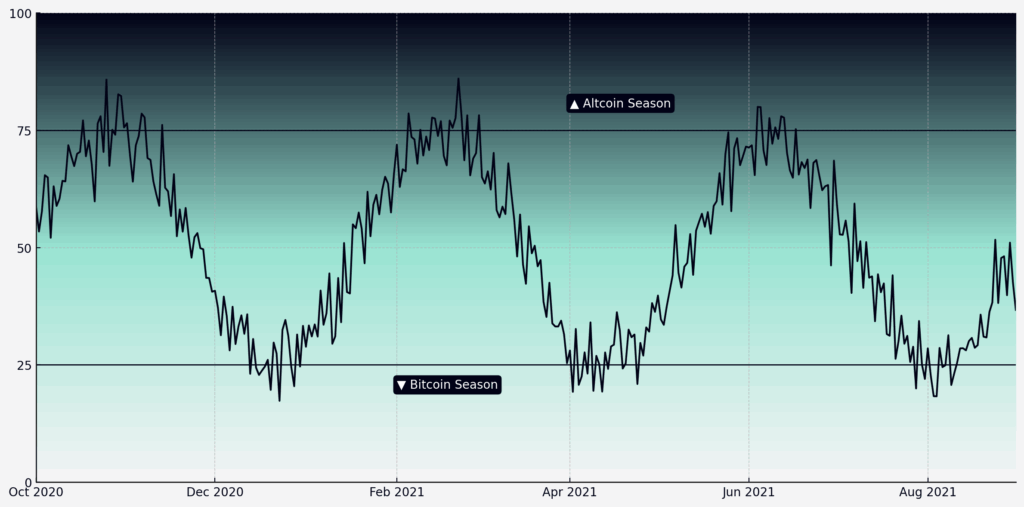

What is the Altcoin Season Index

The Altcoin Season Index is a quantitative measure tracking the top 50 altcoins compared to Bitcoin over 90 days. When at least 75% of the tracked altcoins outperform Bitcoin, the index enters a period where investors have higher profits when investing in crypto rather than in Bitcoin.

Similarly, when the index is below 25%, the market is heavily invested in Bitcoin, which means altcoins are less attractive as an investment in that time frame. Over time, investors have used this metric to identify investment opportunities when Bitcoin is trading sideways.

Difference between Altcoin Season vs Bitcoin Season

Bitcoin season occurs when Bitcoin outperforms most altcoins, typically during the early stages of bull markets when institutional money and conservative investors enter the crypto space. Bitcoin dominance rises during these periods as investors seek the relative safety and liquidity of the largest cryptocurrency.

Conversely, altcoin season emerges later in market cycles when risk appetite increases and investors seek higher returns. During an alt season, Bitcoin’s dominance falls as capital rotates to higher-risk investments and speculative assets that have a greater growth potential.

What happened during previous altcoin seasons

Historical altcoin seasons provide valuable insights into market dynamics and potential future patterns. Two significant periods stand out: 2017-2018 and 2020-2021.

The 2017-2018 altcoin boom

The 2017-2018 altcoin season coincided with the Initial Coin Offering (ICO) boom. Bitcoin’s dominance plummeted from 86.3% in late 2017 to just 38.69% by early 2018. Total altcoin market capitalization exploded from approximately $30 billion to over $600 billion during this period.

Ethereum surged from $8 in January 2017 to over $1,400 by January 2018, driven by smart contract adoption and ICO usage. Ripple experienced even more dramatic growth, rising from $0.006 to over $3, while Litecoin climbed from $4 to nearly $350.

The 2020-2021 DeFi and NFT wave

The 2020-2021 altcoin season was characterized by decentralized finance (DeFi) and non-fungible token (NFT) adoption. Bitcoin dominance fell from 70% to 38% as investors diversified into innovative financial services and digital collectibles.

During the period, Solana emerged as a winner, growing from $1.60 to over $250, while other Layer 1 blockchains like Avalanche and Polygon saw similar exponential growth as scaling solutions gained traction.

How altcoin season works

Capital rotation during altcoins signals when investors are willing to take more risks and seek speculative trades. The process isn’t always the same, but it sometimes rhymes with capital rotation being driven by retail onboarding and a strong narrative.

Why altcoin season happen

Alt season occurs due to two main factors: a decrease in Bitcoin demand and new trends in crypto.

Capital rotation from Bitcoin: After Bitcoin experiences significant price appreciation, it often enters a consolidation phase. Investors seeking higher returns begin reallocating capital to altcoins with perceived greater upside potential. This capital rotation creates upward pressure on altcoin prices.

Emerging blockchain trends: New technological developments and use cases drive investor interest toward specific altcoin categories. Recent examples include DeFi protocols, Layer 2 scaling solutions, AI-integrated tokens, and cross-chain interoperability projects.

How altcoin season starts

Altcoin season starts when Bitcoin’s price stabilizes and trades sideways after a significant rally of at least 200% in the cycle. While Bitcoin’s dominance peaks and begins declining, altcoins in the Top 50 still have room to grow. It starts when large-cap altcoins like Ethereum and Solana start outperforming Bitcoin. It continues with mid-cap gaining traction and seeing increased trade volume across the altcoin markets as retail investors follow institutional lead.

When does altcoin season end

Altcoin season ends when investors are looking to cash in on their profits or as a result of a black swan event, which signals the end of the cycle and the start of a bear market. These periods are short spans during a bull market that can last anywhere from a few weeks to a few months, rather than years.

When altcoin season ends, market sentiment shifts back to Bitcoin or other risk-off assets, macroeconomic factors favor less risky assets, and retail investors who entered during the FOMO stage are left with a high investment and begin to FUD. The transition is often swift and severe with altcoins declining faster than they rose.

Indicators that signal altcoin season

Altcoin season may begin when BTC dominance declines, large-cap tokens outperform Bitcoin over at least 30 days, capital inflow into altcoins increases, and retail traders seek quick investment opportunities.

Bitcoin dominance decline: The most reliable indicator is a sustained decrease in Bitcoin’s market dominance, particularly when it falls below 54%. Sharp drops often precede significant altcoin rallies.

Large-cap altcoin outperformance: When established altcoins like Ethereum, Solana, and Binance begin consistently outperforming Bitcoin, it signals capital rotation toward alternative assets.

Increased trading volumes: Spikes in altcoin trading volumes across major exchanges indicate heightened investor interest and improved liquidity conditions.

Social media sentiment: Growing discussions, trending hashtags, and influencer attention around altcoins frequently precede significant price movements.

How to invest during altcoin season

Altcoin season requires a lot of monitoring and analysis in order to get the timing right. For new investors, it can be a time-consuming process. Even experienced traders can struggle to trade the top cryptocurrencies and stay aligned with their strategy.

If you want to invest in altcoins without monitoring Bitcoin prices or hoping to catch the retail trend, Yieldfund has a solution. Yieldfund provides access to the crypto market for investors who want to generate consistent returns without having to trade the market. The upside is that investors don’t need to learn how to trade or understand altcoins themselves. You just invest, and Yieldfund does all the trading in the background—while providing users with up to 60% yearly interest and weekly payouts in USDC.

Want to find out more about the Yieldfund quantitative trading company and invest in altcoins? Start now and select from one of the three available plans.

FAQ

Is the altcoin season over?

Altcoin seasons are cyclical rather than permanent. While individual altcoin seasons end, new ones emerge based on market conditions, technological developments, and investor sentiment. The key is recognizing these cycles and positioning accordingly.

Why are altcoins so volatile?

Altcoin volatility stems from several factors: smaller market capitalizations make them easier to move with relatively little capital, limited regulatory oversight allows for greater price manipulation, and the speculative nature means prices often disconnect from fundamental value. Additionally, many altcoin projects are early-stage ventures with uncertain outcomes, contributing to price instability.