Bitcoin is a digital currency that has revolutionized the way people use online currency by bypassing intermediaries and creating a decentralized, peer-to-peer system. Bitcoin is widely recognized as the first cryptocurrency, pioneering the use of blockchain technology for digital payments. Since its launch in 2009, it has revolutionized the concept of digital finance, evolving into a legitimate asset class.

For investors considering Bitcoin as part of their investment strategy, understanding its fundamentals is crucial, as tokens operate differently than traditional stocks or other regulated investment vehicles. Understanding what the asset is, is essential for anyone interested in digital assets or blockchain technology.

- Bitcoin is a a decentalized digital currency on a public blockchain network.

- It uses blockchain technology to validate transactions and send payments through a peer-to-peer (P2P) network.

- BTC is the first cryptocurrency to have an approved ETF.

- A cryptocurrency wallet is used to store BTC which holds a record of all network transactions

What is Bitcoin

Bitcoin is a digital cryptocurrency that utilizes blockchain technology to facilitate peer-to-peer transactions without relying on intermediaries to approve transactions. As a digital cryptocurrency, Bitcoin is also considered a virtual currency, operating outside traditional banking systems. It is a form of digital money that enables secure online transactions through a distributed network, where transactions are verified and validated by multiple miners worldwide.

Bitcoin is a new form of money that combines the scarcity principles of precious metals with the convenience of electronic payments. Bitcoin was originally designed as an electronic cash system to enable direct, peer-to-peer payments. It’s often referred to as “digital gold” due to its scarcity and the process by which it’s created, through digital mining.

Bitcoin transactions are recorded on a public ledger called the blockchain, which maintains a permanent, transparent record of all activity. This system eliminates the need for trusted third parties while ensuring the integrity of every transaction through cryptographic verification. Unlike bitcoin, stablecoins are linked to traditional currencies and are less susceptible to drastic value fluctuations. One bitcoin can be divided into eight decimal places, with the smallest unit called a satoshi. The divisibility of one bitcoin into many decimal places allows for small transactions and flexibility. There is an ongoing debate about Bitcoin’s intrinsic value, with some experts arguing that it lacks inherent value compared to traditional assets like gold or fiat currency.

How does BTC work

Bitcoin operates through a public ledger that records every transaction anonymously, leveraging blockchain technology, cryptographic security, and economic incentives to maintain a secure and decentralized network.

When new transactions are initiated, each BTC sent is broadcast to the entire network. The transaction is then verified by several Bitcoin validators to ensure its accuracy and ownership verification, confirming the legitimacy of each transaction and the ownership of bitcoins before being recorded on a block. All data stored in each block is cryptographically hashed to ensure data integrity and security.

On the blockchain, blocks are linked chronologically, with each block containing a reference to the previous block, ensuring the chain’s integrity and resistance to tampering. Only valid transactions are included in new blocks after verification. Miners group new transactions, validate them, and add them to a new block, which is added to the blockchain approximately every 10 minutes. New blocks contain verified transactions, and miners process transactions to maintain the blockchain’s security.

Through the proof-of-work consensus mechanism, miners who use specialized computers with high processing power (GPUs) solve complex mathematical problems. When a miner solves one of the problems, it validates the new block, which contains several transactions.

Successful miners are rewarded with newly created BTC, with currently 3.125 BTCs being rewarded per block, and this reward undergoes a halving process every four years. To maintain incentives and create a deflationary monetary policy, the Bitcoin network reduces the rewards per block.

Who created Bitcoin

Bitcoin was created by Satoshi Nakamoto, an anonymous person who used the pseudonym. The first mention of the asset appeared in October 2028 in a whitepaper published by Satoshi Nakamoto, highlighting how decentralized digital currencies could operate without third parties. The genesis block happened on January 3rd, 2009, with the first BTC being mined.

How are Bitcoin transactions and payments made

To use Bitcoin, users need to have a wallet, synchronize their wallet with the Bitcoin network, and pay a transaction fee to incentivize miners to include their transaction in a new block. BTC tokens can only be sent through a wallet, whose role is to provide access to all transactions ever recorded on the blockchain.

To make a payment using Bitcoin, users need to know the wallet address of the recipient. The address is a string of random numbers and letters. To continue with the transaction, the wallet creates a digital signature using the user’s private key. In the background, miners validate transactions, help verify their validity by solving complex mathematical equations.

Unlike traditional payments, Bitcoin eliminates the need for additional verification through a direct peer-to-peer transfer.

How is Bitcoin used

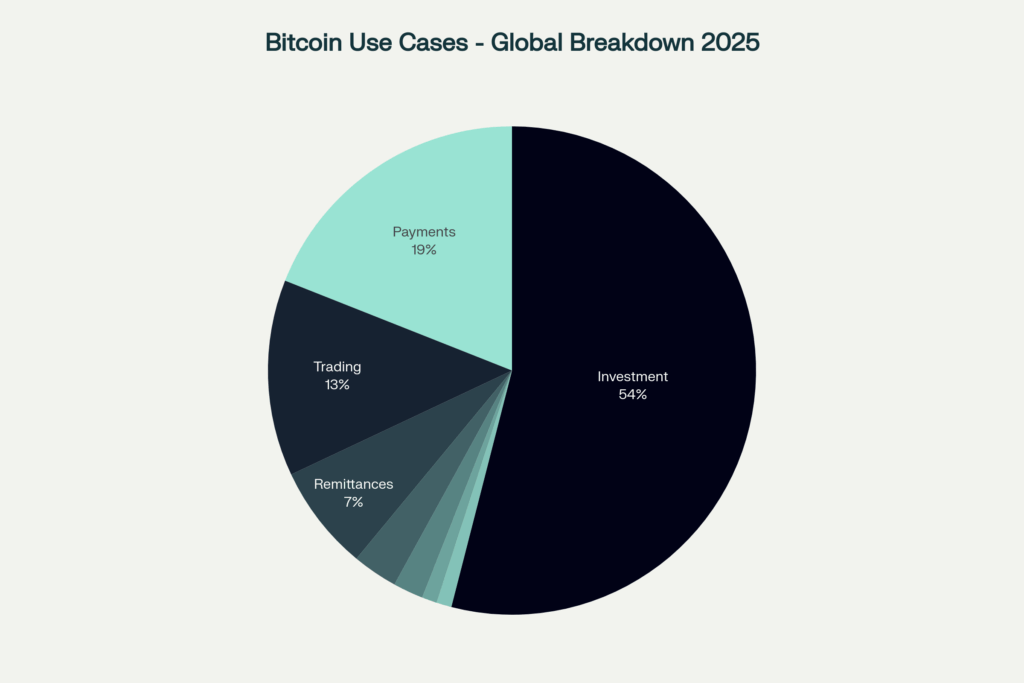

Bitcoin has a number of use cases with a wide majority of users in 2025 seeing the asset as a store of value, with 54% of users storing it for the long term. Additionally, payments make up 19% of BTC use cases, including in e-commerce, goods and services, and purchases. Only 13% of users rely on speculation or trade, leveraging BTC for profit or short-term market opportunities. The pie chart below provides a larger overview of the three main use cases.

Other use cases, which are still part of why Bitcoin was created, include remittances (7%), where Bitcoin’s low-cost and cross-border capabilities play a growing role in developing markets. Businesses are also adopting Bitcoin, with 3% using it as part of their corporate treasury for liquidity management or as a balance sheet asset. Smaller segments include donations and crowdfunding (2%), online gambling (1%), and niche applications like micropayments and blockchain games (1%). Together, these diverse use cases highlight Bitcoin’s evolving role in the global economy.

How is BTC different than fiat

Bitcoin differs from traditional currencies as it is not controlled or managed by any central authority or banks. While fiat currencies can be printed, often leading to interest rate changes and capital restrictions, Bitcoin can only be mined. As a decentralized currency, it cannot be manipulated by any entity.

One of Bitcoin’s most defining features is its scarcity. While fiat currencies can be printed in unlimited amounts, Bitcoin has a total supply of 21 million coins. At the time of writing, there are 19.8 million tokens in circulation. During periods of inflation or economic uncertainty, Bitcoin’s ability to retain value makes it particularly unique compared to other assets.

Bitcoin mining

The mining process is the backbone of the Bitcoin network, responsible for both the creation of new Bitcoins and the security of the Bitcoin blockchain. This process involves miners using powerful computers and specialized hardware to solve complex mathematical puzzles. Each time a miner successfully solves one of these problems, they validate a block of bitcoin transactions, ensuring that every transaction is legitimate and that no bitcoin is spent twice.

Mining requires significant computing power, which translates into high energy consumption and operational costs. Despite these challenges, miners are incentivized by the rewards they receive: newly minted bitcoins and transaction fees from the transactions included in each block. As more miners join the network and the difficulty of the puzzles increases, the competition for these rewards intensifies, further securing the entire bitcoin system.

What are Bitcoin cycles

Bitcoin’s halving events, which occur every four years, are incremental to miner incentives. Miners’ blocks are halved every four years, with block rewards decreasing. As a result, Bitcoin has entered four price cycles in its history, peaking in 2011, 2013, 2017, and 2021. The most recent one is in 2025, which is yet to be finalized.

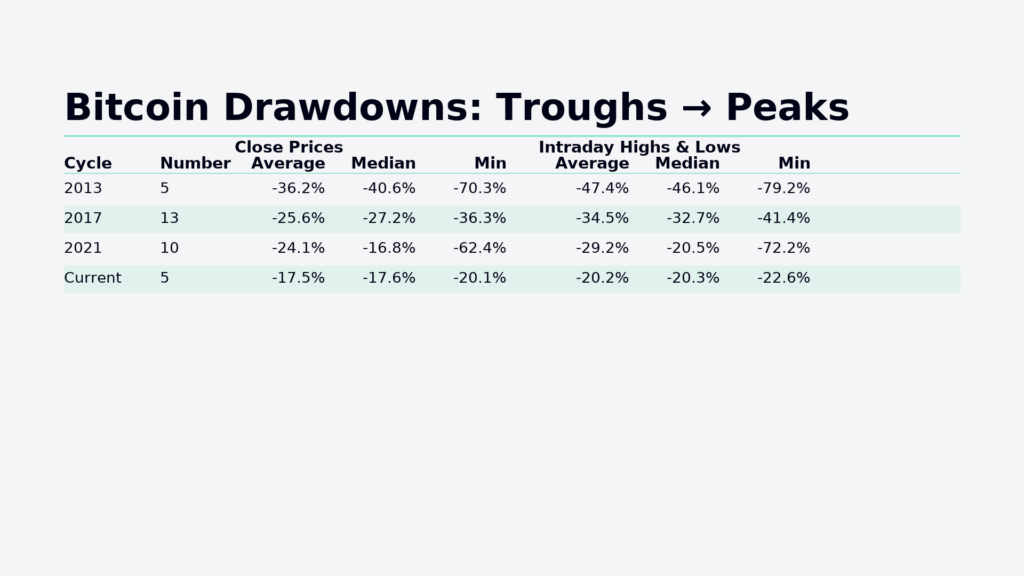

Prices are often driven up by token scarcity, which then results in a price drawdown to create more liquidity for market makers. Data suggests that over the years, drawdowns during Bitcoin cycles have decreased. During 2013’s cycle, the cryptocurrency experienced significant drawdowns between 40% and 70%, with a median of 46.1%. In 2017, the average drawdown was around 32.7%, while in 2021, the drawdown was higher at 62.4%, driven by geopolitical factors.

The current cycle has seen drawdowns averaging 20%, which shows how BTC volatility continues to decrease. This is primarily due to higher Bitcoin liquidity and positions on major exchanges driven by Bitcoin ETF acceptance.

Bitcoin changes post-ETF approval

The approval of the spot Bitcoin ETF on January 10, 2024, has significantly transformed the investor landscape. The adoption attracted over $14.8 billion net inflow in BTC with BlackRock’s IBIT surpassing $50 billion. However, the most impactful change occurred in 2025 as companies adopted the asset in their corporate treasuries. By Q2 2025, corporate balance sheets collectively added over 850,000 BTC, an 18% increase from the previous quarter.

For three consecutive quarters, corporate buyers have outpaced ETF inflows, highlighting a growing institutional appetite that extends beyond passive investment vehicles. As of now, ETFs collectively hold 1.4 million BTC (6.8% of the circulating supply), while corporate treasuries account for 855,000 BTC (4% of the supply). Institutional investors own 22.9% of total ETF assets, with advisory firms increasing their exposure, while hedge funds have strategically taken profits.

Regulatory developments accelerated adoption, including 401(k) exposure to the market, unlocking potential $12 trillion in retirement capital, and FASB fair value accounting, removing balance sheet barriers. This infrastructure is creating a demand from institutional players, driving sustained price appreciation and increased adoption.

Pros and Cons

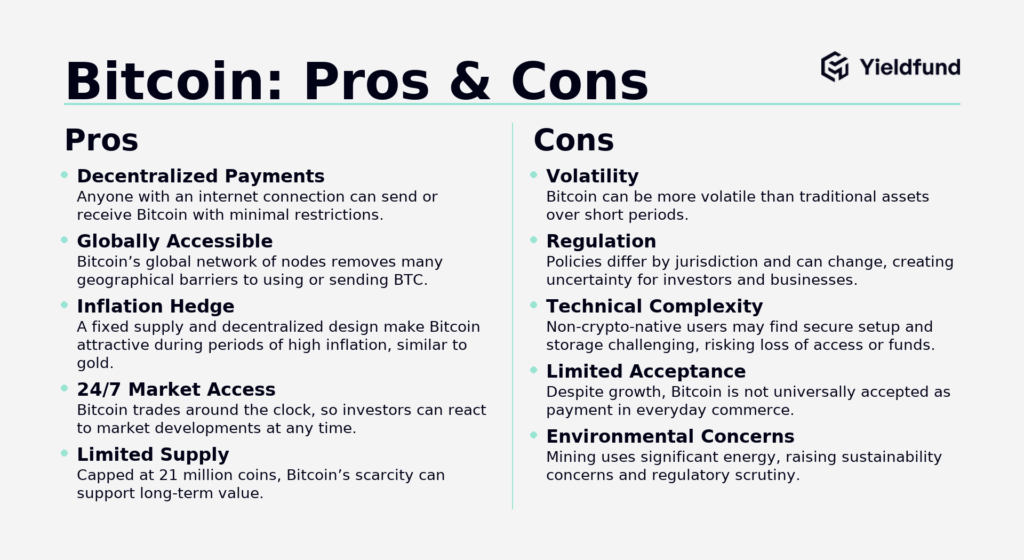

While the token is praised for gaining a large following and contributing to significant growth over the years, let’s analyze the pros and cons.

Relationship to other digital currencies

While Bitcoin is the first and most widely recognized digital currency, it has inspired the creation of thousands of other digital currencies, often referred to as altcoins. These alternative digital currencies, such as Ethereum, Litecoin, and Bitcoin Cash, are built on similar blockchain technology but often introduce unique features or improvements. For example, some altcoins offer faster transaction processing, lower transaction fees, or enhanced privacy options.

Many altcoins aim to address perceived limitations of Bitcoin, while others focus on specific use cases or industries. Despite the growing number of digital assets, BTC remains the benchmark for the market with the highest market cap. It often influences the value and adoption of other cryptocurrencies. As blockchain technology evolves, the interplay between the leading cryptocurrency and other digital currencies continues to shape the future of digital finance.

Final words

Bitcoin represents a fundamental shift in how users think and use money. As it’s built contrary to centralized systems, it creates a new alternative for how users can freely and securely send currency and retain financial sovereignty over governments and other centralized entities. It creates new opportunities for financial innovation and inclusion by enabling open, decentralized transactions.

It offers new alternatives to previously flawed systems, and Satoshi Nakamoto built a system with programmed scarcity that is more adapted to the needs of the new digital era. The asset has evolved from a digital currency towards a store of value, investors are eyeing potential investment opportunities, which have transformed the token into something it once wanted to stand against.

As BTC continues to become embedded into everyday financial activities, understanding how it works, its storage requirements, and its fundamental differences from traditional assets is important.

FAQ

How is Bitcoin stored?

Bitcoin is stored in a wallet. These wallets are digital devices that prove the owner of the passkey holds the asset in their wallets, as it helps verify ownership of the asset. Today, users can use both hot or cold wallets, with the former storing BTC online, while the latter stores it offline, which is more secure.

Can Bitcoin be hacked?

Yes, the network can be hacked, but it’s highly unlikely that it can happen. Blockchain hacking occurs when there’s a 51% attack on the network, which means 51% of the computation power has to be done by a single entity.

When Bitcoin started?

The first token was mined on January 3rd 2009 during the first genesis block.

Which BTC ETF is best?

Choosing the best ETF depends on your investment strategy and goals. There are a few examples such as Grayscale Bitcoin Trust (GBTC), BlackRock’s (IBIT), or Fidelity ETF (FBTC).