Market cap or capitalization is a key metric that measures the overall value of a cryptocurrency, and it’s something every investor should understand. In this article, we describe what market capitalization is, how it’s calculated, and how it differs from other metrics in the market.

- Key Takeaways

- What is market cap in crypto

- How is market cap calculated

- What does crypto market cap mean

- Why market cap matters

- How market cap differs from other metrics

- Difference between small, mid, and large-caps

- Evaluating growth potential in crypto projects

- Characteristics of a good crypto market cap

- Limitations of market cap as a metric

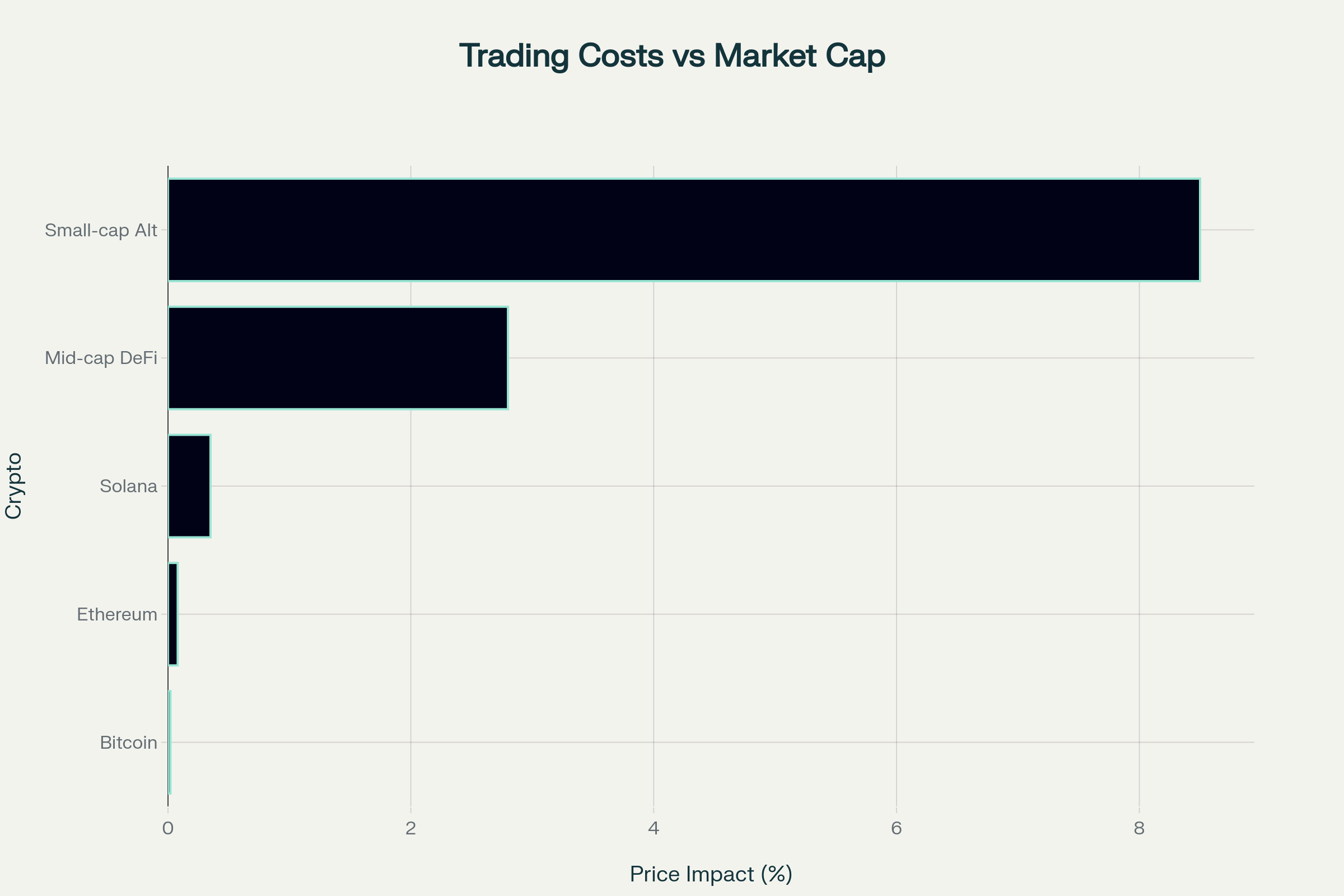

- Comparing the costs of trading small, medium, and large-cap tokens

- Final words

- FAQ

Key Takeaways

- Crypto market cap is calculated using the amount of cryptocurrencies in circulation

- Investors should look at the total market cap and the existing market cap when assessing a cryptocurrency

- Trading small-cap tokens has 425 times higher trading costs than simply trading Bitcoin

What is market cap in crypto

Market cap in crypto is the measure of a cryptocurrency’s overall value, calculated by multiplying the current price of the token by the number of available tokens. The calculation uses the market price, or the latest cryptocurrency prices, to determine the total value. Since most discussions are often filled with technical terms, market capitalization (or market cap) is a term that everyone needs to understand.

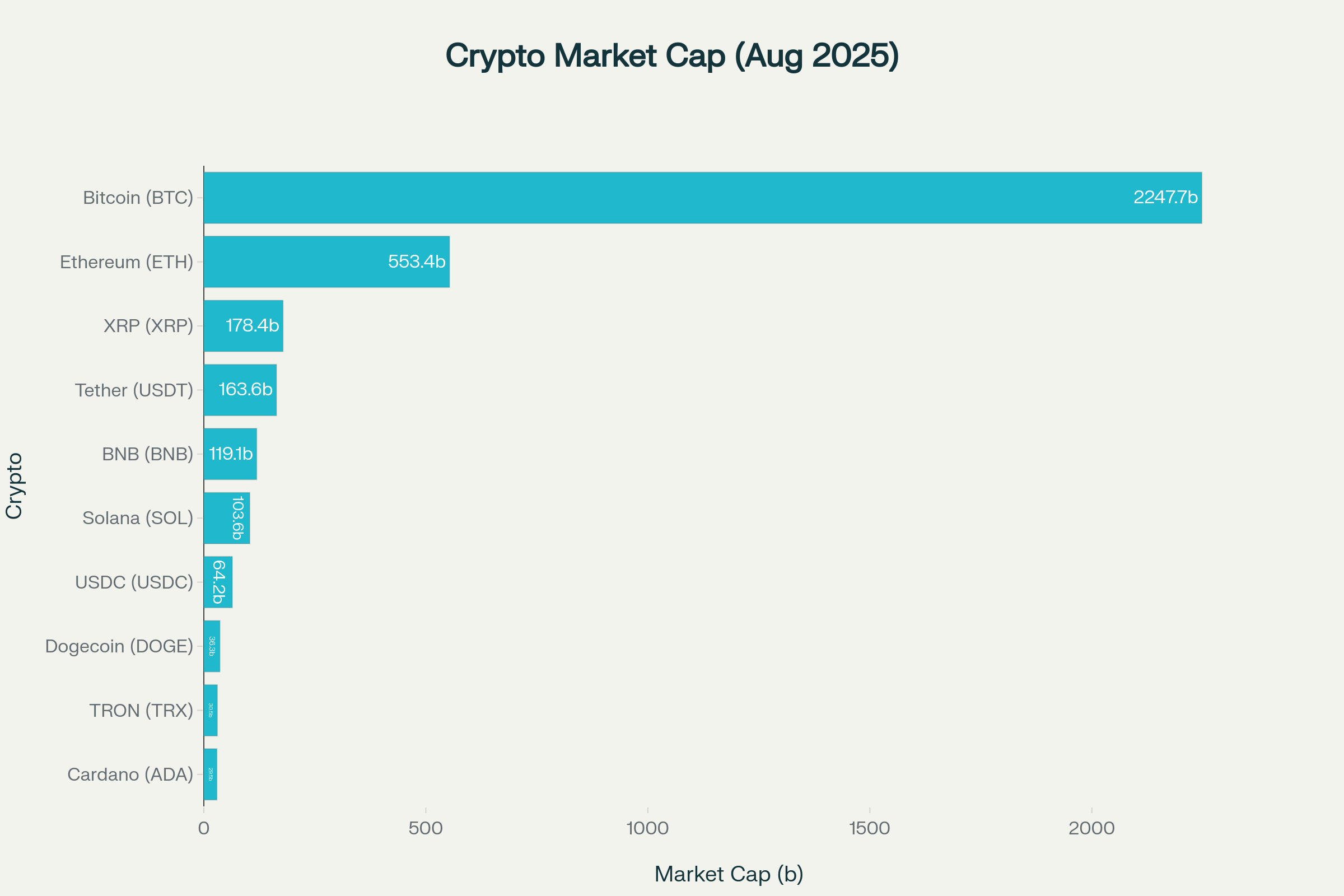

A token’s value is often used to compare and rank cryptocurrencies, helping to determine which holds the greatest worth. For instance, Bitcoin boasts the highest market capitalization among all cryptocurrencies and remains far more established than many lesser-known tokens.

How is market cap calculated

Calculating the market capitalization of a cryptocurrency involves multiplying the current price by the existing circulating supply. Below is a simple formula that illustrates this:

Market Cap = Current Price × Circulating Supply

To provide a concrete example, if the price of Bitcoin is $100,000 and there are a total of 19,899,359 tokens in circulation, the market cap of Bitcoin at the time of writing this article is 1.989 trillion USD. This then represents the total value of a cryptocurrency at its current price. Some platforms use an average price from multiple exchanges to determine the market cap, which helps account for price variations across markets.

In the stock market, market capitalization is calculated by multiplying the current share price by the number of outstanding shares. The same principle applies in the cryptocurrency market, where the circulating supply is multiplied by the current price.

Market cap is calculated using the circulating supply and not the maximum supply. Cryptocurrencies have a fixed maximum supply, which, in the case of Bitcoin, is 21 million coins. Others can have more or less, depending on their tokenomics.

Here is what you need to know when talking about a token’s supply:

- Circulating Supply: Tokens that are currently available on the market.

- Total Supply: Includes all tokens that have been created, including those that are locked or reserved.

- Max Supply: The maximum amount of tokens that can be minted.

What does crypto market cap mean

For cryptocurrency investors, market capitalization (market cap) is one of the primary indicators of a token’s valuation. It provides the first point of contact for investors who want to assess whether the token is undervalued or overvalued. Market capitalization (market cap) plays a crucial role in the investment decision-making process by helping investors evaluate the potential and risk of a token, much like a company’s market capitalization is used in traditional markets.

Additionally, it also shows the potential upside and whether the current market cap is sustainable, given what the project delivers and provides to the community.

What is total market cap

Total crypto market cap refers to the combined market value of all cryptocurrencies. This number helps track the growth of the overall cryptocurrency market. Any movement in the overall market cap signals whether the industry is growing or slowing down and provides a snapshot of the market’s overall health. When the total market cap rises, it often signals increased investor confidence and adoption, while at the same time, a sharp decrease signals investor reluctance and a lack of interest in risk-on assets.

Why market cap matters

The figure provides a brief overview, omitting an analysis of a token’s size, which is crucial as it enables investors to delve deeper, assess potential risks, and identify trends to follow if a token’s market cap has risen significantly over a short period. Here’s why market cap matters:

Risk assessment

Small- or medium-sized market-cap tokens exhibit higher volatility and have yet to be proven. While Bitcoin or Ethereum have a higher capitalization, smaller caps can pose more risks for investors. Whether it’s volatility, security risks, or scam risks, a token’s market cap gives users a way to assess their investment. Market cap also helps investors identify potential investments by providing insight into the relative values and risk profiles of different assets.

Investor Insight

Market cap is a straightforward way to measure a company’s size or a cryptocurrency’s size and its position in the market. In traditional markets, market cap is used to assess a company’s size and value, helping investors compare company market values and make informed decisions. It’s more reliable than relying solely on the coin’s price, which can be misleading.

Market trends

By examining how a token’s value fluctuates over short periods, investors can gauge market sentiment as well as industry trends. Observing changes in market cap values can reveal shifts in a company’s market or a crypto asset’s market position. Regardless of whether it’s a bull or bear market, some investors can identify where smart money is allocated by simply observing market cap rotations.

How market cap differs from other metrics

While market cap is an important measure, it’s not the only way to evaluate cryptocurrencies. It differs from other metrics because it aligns the value of the token with the circulating supply. Instead of looking at the potential price of the token based on the total supply, market cap provides an accurate price estimation.

In traditional finance, market capitalization is commonly used to assess the value of publicly traded companies. While both crypto and publicly traded companies use market cap to gauge value, crypto market cap is based on tokens in circulation, whereas in traditional markets, it is tied to shares listed on stock exchanges.

Additionally, a project’s tokenomics can vary significantly, with factors like vesting schedules, token releases, and the minting of new tokens influencing the price. What’s important, however, is how dominant the token is in relation to the general market – this, however, only applies to large-cap tokens, such as Bitcoin.

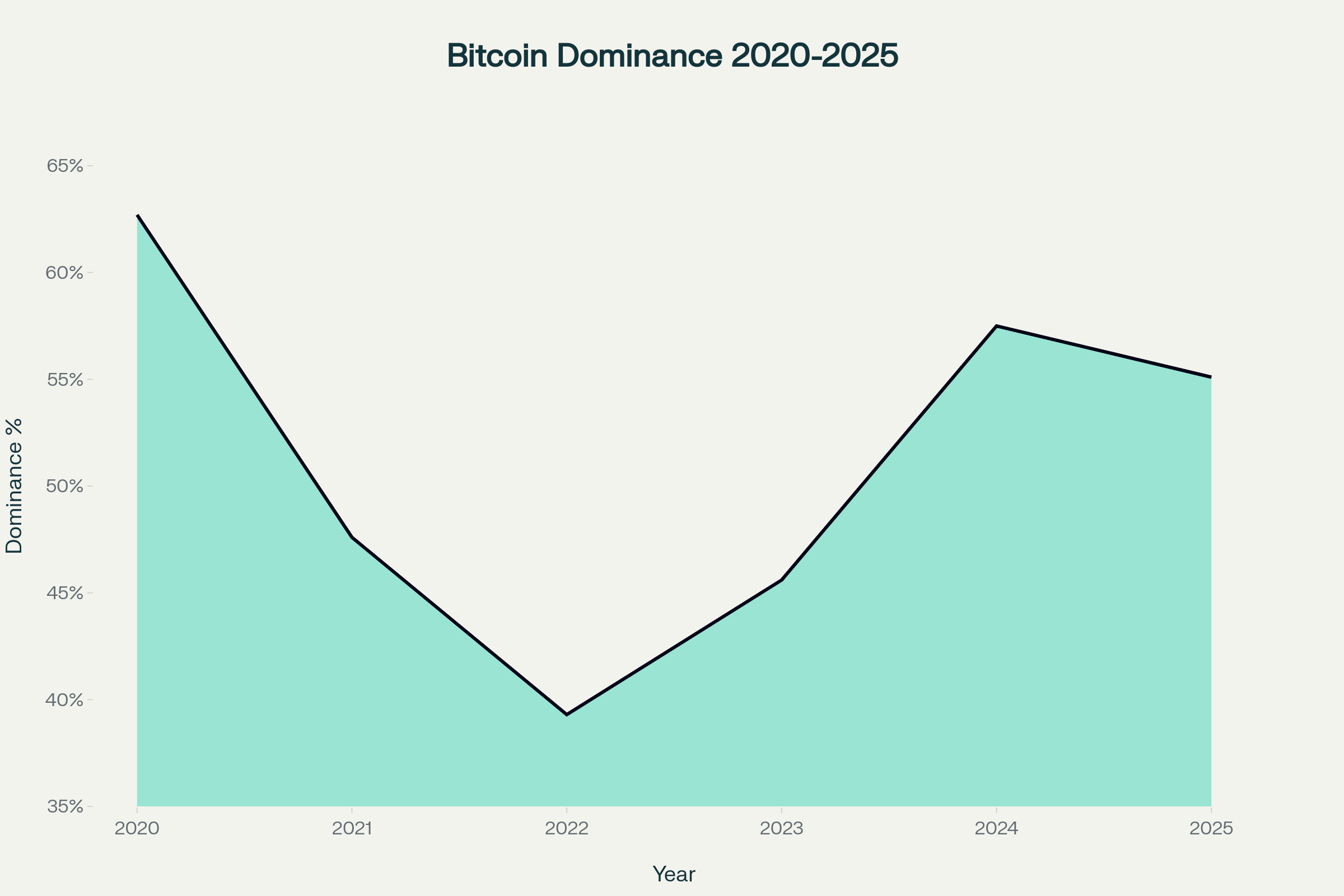

Token dominance refers to the share of the entire cryptocurrency market that a specific asset, most notably Bitcoin, represents. Market capitalization indicates the total value of an individual asset, but dominance takes it a step further by highlighting the percentage of the overall market that asset accounts for in relation to all others. For example, Bitcoin’s dominance is often viewed as a measure of its influence and stability within the broader cryptocurrency ecosystem.

Trading volume measures the amount of a cryptocurrency that was traded over a set time—high volume often indicates more active buying and selling. Volume is linked to the market cap, as higher volume leads to different outcomes depending on the market cap’s size.

Difference between small, mid, and large-caps

The crypto industry has created a ranking system for tokens based on their capitalization, which categorizes them into small, medium, and large caps. Cryptocurrencies are grouped into different market capitalizations or market caps, similar to how stocks are categorized by size, such as large-cap, mid-cap, and small-cap. Here’s how they compare to one another:

- Large-Cap Cryptos (Over $10B): These include well-known names like Bitcoin (BTC) and Ethereum (ETH). These are considered large-cap cryptocurrencies and are similar to large-cap stocks, which are well-established and often include the largest companies in the market.

- Mid-Cap Cryptos ($1B-$10B): Assets like Solana (SOL) and Polkadot (DOT) fall here. These are mid-cap cryptocurrencies that can experience rapid growth but also carry higher risk. They offer growth potential but come with slightly more risk compared to large-cap options.

- Small-Cap Cryptos (Under $1B): High-growth, high-risk investments involving less established coins or niche projects. These are often referred to as small caps or small-cap stocks, which typically represent young or smaller companies that serve niche markets and have the potential for high returns, but also higher volatility.

Understanding the differences between market capitalizations enables investors to select potential investments that align with their risk tolerance and growth objectives.

Evaluating growth potential in crypto projects

When assessing the growth potential of crypto projects, investors should look beyond just the current market cap. While a high market capitalization can signal strong market confidence and established value, it’s equally important to analyze the project’s underlying technology, team expertise, and real-world use case. Projects with innovative solutions, active development teams, and a clear path to adoption often demonstrate greater growth potential, even if their market cap is still developing.

Investors should also pay close attention to market trends and the competitive landscape. A project that addresses a unique need or serves niche markets may have a higher chance of rapid growth, especially if it stands out from competitors. Reviewing the project’s whitepaper, roadmap, and level of community engagement can provide deeper insights into its long-term prospects. By combining market capitalization analysis with a thorough evaluation of fundamentals and market dynamics, investors can better identify crypto projects with strong growth potential and make more informed investment decisions.

Characteristics of a good crypto market cap

A good market cap in crypto shows how reputable a token is in the eyes of investors. As of August 2025, Bitcoin and Ethereum collectively hold over 70% of the total market value. That said, according to CoinGecko, Bitcoin holds approximately 56.59% of total market capitalization, while Ethereum’s stake is over 15% of the total.

For projects with higher market capitalizations, this translates to higher investor confidence, increased liquidity across all exchanges, and greater interest from institutional investors. Examining the regulatory environment, the SEC has only approved ETFs for major cryptocurrencies, such as BTC and ETH. This means the project’s fundamentals are stable; they have higher market shares, are more trustworthy than newer projects, and can convey investors ‘ confidence. Additionally, and most importantly, good projects are more secure and less susceptible to 51% attacks on the network.

Thus, by focusing on characteristics such as project foundation, first-to-market, hashrate, or number of validators, investors can better identify crypto assets with a good market cap and strong potential.

Limitations of market cap as a metric

While market cap is a helpful tool for getting a quick sense of a cryptocurrency’s size, it can be misleading—especially for smaller caps. In such cases, even smaller purchases on-chain can inflate the market cap and make it appear much larger than it truly is.

Another issue comes from the “fully diluted” valuation, which includes all possible tokens—even those not yet released into the market. This approach can give an inflated sense of a project’s value, as it doesn’t reflect the actual number of tokens that people can buy or sell at present.

Additionally, market cap doesn’t measure how much actual money has moved into or out of a cryptocurrency. A coin’s price might move sharply due to speculation or low trading volume, which also affects its market cap but doesn’t always reflect real-world volume or investor confidence.

Comparing the costs of trading small, medium, and large-cap tokens

A price impact analysis reveals how trading various tokens affects their overall costs. Trading small-cap tokens is 425 times more costly than trading large-cap tokens like Bitcoin for the same transaction size. The difference generated by the lack of liquidity and high slippage creates barriers for institutional participation.

Bid-ask spreads demonstrate similar patterns, with large-cap cryptocurrencies maintaining 0.01-0.02% spreads compared to 1.25% for small-cap alternatives. These tight spreads enable efficient price discovery and reduce transaction friction for professional trading operations.

Market makers focus their activity on high market-cap assets, as professional liquidity providers require substantial trading volumes to justify their efforts. This creates a concentration effect, forming positive feedback loops where liquid assets become even more liquid, while illiquid assets continue to face challenges in achieving efficient tradeability.

Final words

Market capitalization (market cap) is a key metric every investor, whether new or experienced, should understand. Even if you’re not actively trading, knowing what it means is essential. For those who want to avoid the complexities of crypto trading but still want to invest in cryptocurrencies, Yieldfund offers the perfect solution.

As a quantitative trading company, Yieldfund provides investment plans with weekly payouts and returns of up to 60% annually. Best of all, our hands-off approach allows you to reap the benefits of crypto investing without the need to actively trade.

FAQ

When does market cap increase?

Market cap can increase when the price of a token increases following multiple buy orders, or when more coins enter circulation at a stable price.

What market cap is considered a small cap?

A project or token is ranked as a small-cap if the total market capitalization is below $1 billion.

How market cap works?

You find the market cap of a cryptocurrency by multiplying the current price by the circulating supply. The final number represents the total market cap of a token.

Total market cap without BTC

Bitcoin has over 50% of the total market cap, and the total market without BTC is $1,750 trillion.

Which crypto has the highest market cap?

Bitcoin is the cryptocurrency with the highest valuation. At the time of writing, Bitcoin’s capitalization was around $2.339 trillion.