- The Copy Trading Market Phenomenon

- Methodology

- Methods and Limits

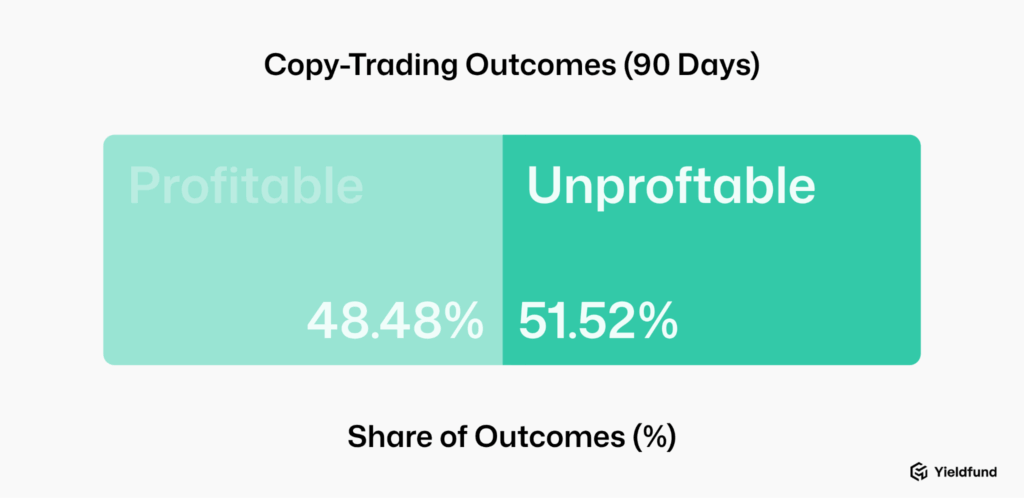

- Only 48.48% of Copy Traders Were Actually Profitable

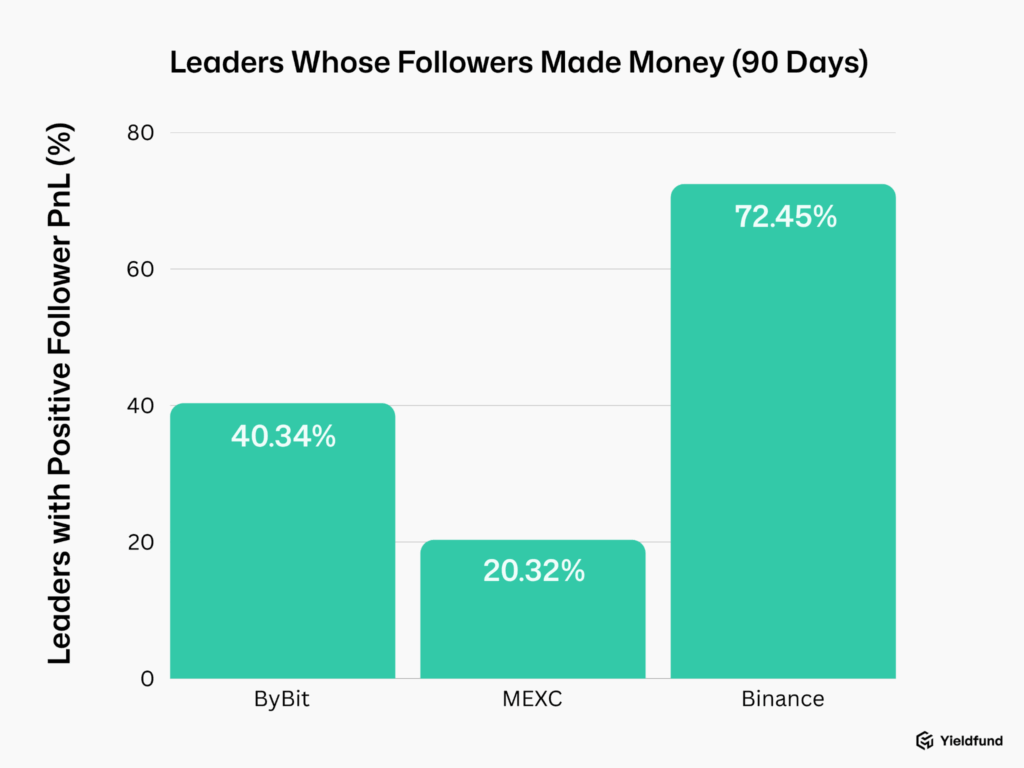

- 97% of Leaders Were Green, But Only 43.61% Delivered Positive Follower Returns

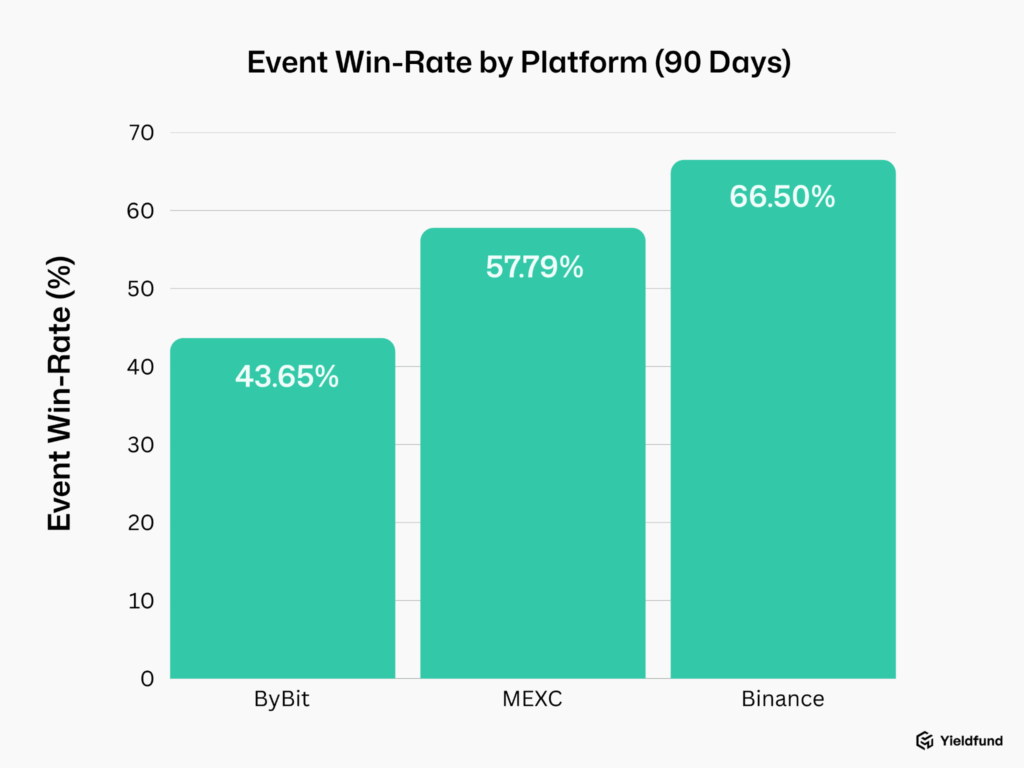

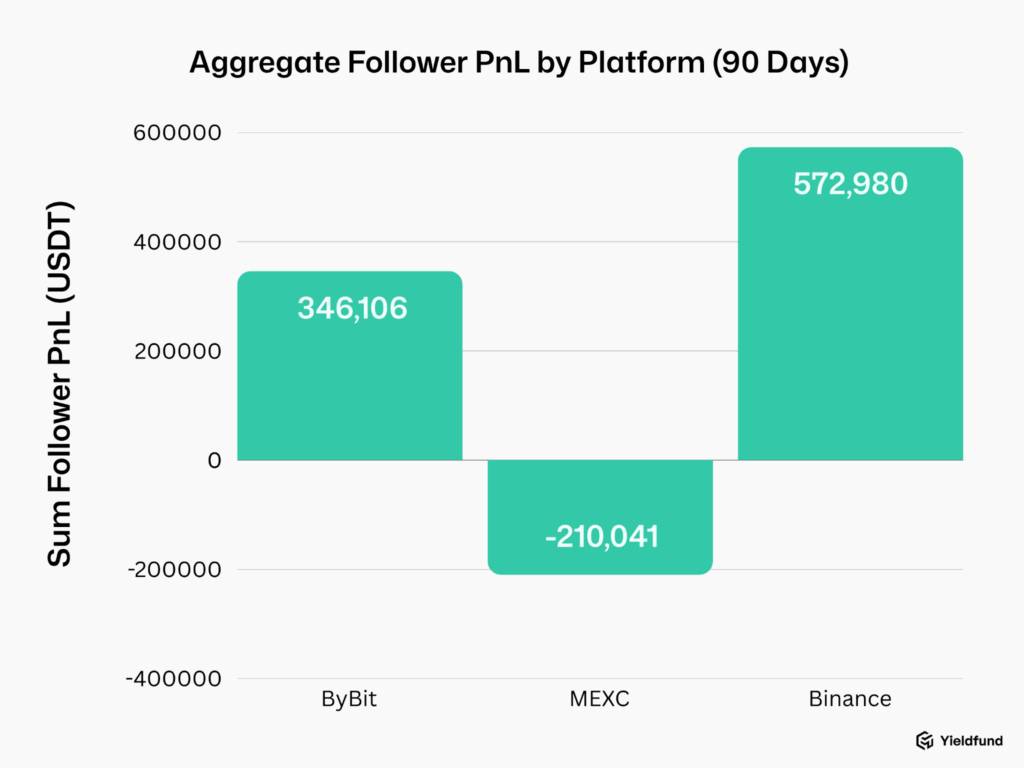

- Binance & Bybit Net-Positive; MEXC Net-Negative in Our 90-Day Sample

- Evidence Driven Guidance for Copy Traders

- Data Insight and Future Prediction

- Copy traders win less than half the time. Across 100,236 copier outcomes, only 48.48% finished profitable.

- While 97.04% of leaders were green on their own PnL, only 43.61% of leaders produced positive follower PnL.

- Aggregate follower PnL is +709,045.44 USDT overall

- Win rate alone is not enough. A platform can show >57% wins and still have followers lose money when the average loss > the average win.

Cryptocurrency markets are volatile and widely accessible. This report analyzes copy-trading outcomes over a 90-day window across three exchanges.

Data published on the state of automated trading in crypto shows that over 70% of trading volume is automated. However, retail is looking for similar ways to approach the market.

Retail traders who engage in manual trading frequently experience losses. According to a study by NFTEvening, 84% of traders lose money in their first year of trading. Additionally, automated trading systems tend to yield better results than manual trading, with win rates ranging from 65% to 75%, compared to only 35% to 40% for manual traders.

As trading continues to evolve alongside rapid technological advancement, retail traders nowadays have access to platforms and systems that make participation in financial markets more accessible.

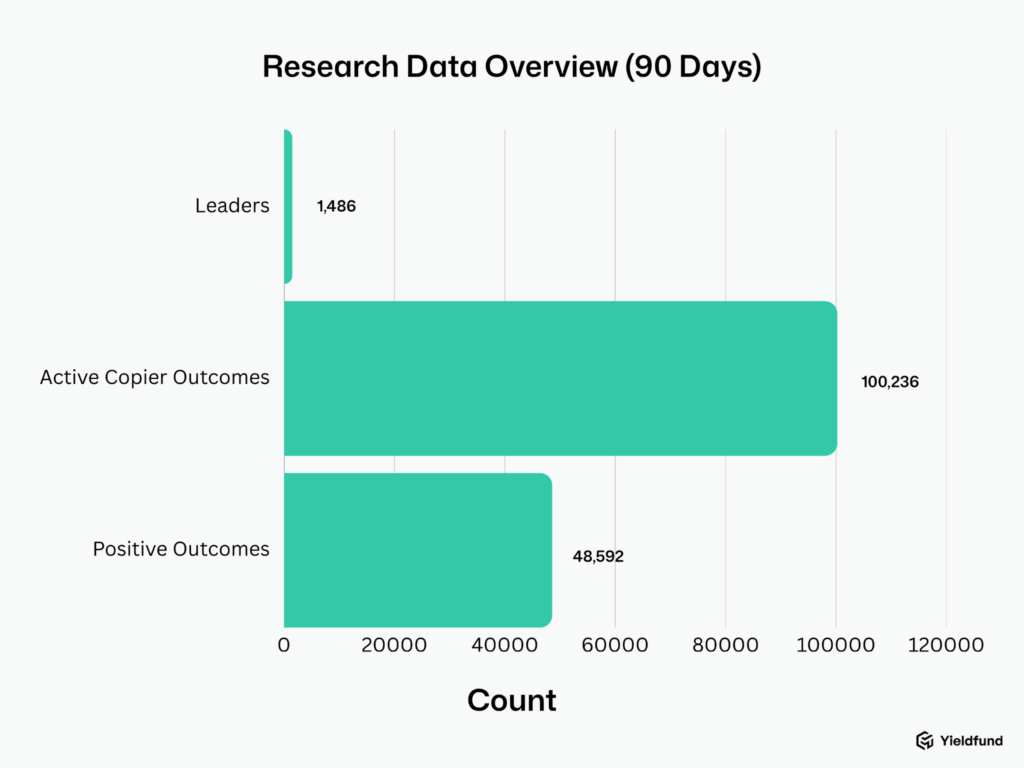

We set out to answer a simple question: Is copy trading actually profitable for users? Using our cleaned, 90-day dataset across Binance, Bybit, and MEXC, we analyzed 100,236 copy-trading outcomes. We tracked event-level results (wins/losses), leader PnL, and Follower PnL to compare what leaders earn versus what their followers actually receive.

The Copy Trading Market Phenomenon

Copy trading has emerged as a way to simplify decision-making and bridge the knowledge gap between newcomers and experienced traders.

The entire notion of copy trading is rooted in how online behaviour has changed the way people trade. 44% of copy trading done on crypto platforms is done by Gen Zs. Furthermore, access to information is no longer enough; digital traders seek platforms with familiar mechanics—like social networks. Thus, the idea of socialization as a familiar way to gather information can be mirrored in copy trading.

Thus, through copy trading, exchange platforms become ecosystems for knowledge exchange and an easy way to trade without allocating time, only financial resources. That is why the global social trading market is expected to reach $3.51 billion by 2029.

More significantly, copy trading in regions such as Europe and the UK, where investors have more ways to diversify, has been rising by up to 38% annually.

As more retail traders adopt copy trading, we have had to ask ourselves a few important questions: how profitable are these trading strategies, do copy traders really generate positive ROI, and whether copy trading can effectively bridge the trading experience gap for retail traders.

Methodology

To assess the validity of our parameters, we manually reviewed the Top crypto exchanges by 24-hour trading volume on October 24th, 2025. Given limitations on some platforms, the decision was to focus on three platforms: Bybit and Binance, which have a trust score of 10/10, and MEXC, which has a trust score of 9/10 based on CoinGecko data.

Our decision did not take into account the number of available assets, nor did we base it on the number of lower- or higher-cap assets.

Additionally, To ensure feature parity with non-EU product availability, data were collected from the Dubai market view under identical parameters.

With data gathered in October and the report published in November 2025, there will be some discrepancies between the current data on the exchange and our existing data.

Finally, the extracted data was added to a Google Sheet, with three tabs for each platform. In each tab, the following data was extracted: Exchange, Trader name, Total ROI %, Total PnL, Follower PnL, Followers, Profitable, Unprofitable, and No Interaction.

Methods and Limits

| Scope | 90-day window; three exchanges; 100,236 event outcomes; 1,486 leaders. |

| Definitions | User outcome = Profitable vs Unprofitable event counts |

| Comparability | ROI/PNL definitions vary by platform; we therefore rely on PnL sign and event counts. |

| Limits | Event-weighted; fees/funding/slippage not decomposed; market regime can change results. |

| Time-bounded | Findings describe this 90-day sample only. |

Only 48.48% of Copy Traders Were Actually Profitable

Our research indicates that only 48.48% of copy traders who follow leaders are actually profitable. In our analysis of 100,236 outcomes, we found that 48,592 trades were winning, while 51,644 trades resulted in losses.

Looking at the market, the results approach 50% but are below break-even once fees, funding, slippage and occasional large losses are considered.

A 2018 study on copy trading shows that losses from copy trading are actually higher than those from non-copy trading. In contrast, returns from leaders are often smaller than the potential setback. This supports our findings, even though the percentage difference is smaller, at less than 2%.

What is interesting is how specific platforms have varying success rates for copy traders. Our findings show that returns are platform-dependent: Binance copiers have a 66.5% win rate, MEXC a 57.79% win rate, and Bybit only a 43.65% win rate.

In our research, we found that both Bybit and Binance have a trust score of 10 out of 10, while MEXC has a lower trust score of 9 out of 10. All these platforms have 24-hour trading volumes exceeding $4 billion. As of October 24th, 2025, Binance reported higher 24h volumes than the other platforms we analyzed. We did not evaluate trader experience, selection breadth, or causality behind these differences.

Still, the blended result lands below 50%, showing how uneven distribution and loss sizing on specific platforms can drag overall performance.

The data suggests copy trading can work under the right conditions. However, absent disciplined filters, the average follower is unlikely to outperform chance once costs and tail risks are factored in.

97% of Leaders Were Green, But Only 43.61% Delivered Positive Follower Returns

From a lead trader’s perspective, our research shows a consistently strong performance profile. Across the entire sample, 97% of lead traders recorded a positive PnL over 90 days, indicating that most leaders are indeed profitable when trading with their own capital.

Their success does not automatically pertain to traders who follow them. That is why only 43.61% of leaders were able to produce positive PnL for their followers. The approximately 50% gap shows the discrepancies between trading with knowledge and following without independent analysis. These data is reflective only in our 90-day sample and may vary with market regime and platform methodology

A 2019 study emphasizes that copy trading, due to its social aspect and traders’ lack of knowledge, is similar, in many cases, to a lottery. As our data show, traders with high ROI and a considerable following are typically preferred, while those with few followers (even if profitable) are under-selected.

Moreover, a leader’s 90-day track record does not always guarantee the same results for the copy trader. That is because leaders initiate trades before copiers; followers may enter positions later at different prices. Additionally, risk metrics and execution details are not always shown on public profile pages and can contribute to differences between leader ROI and follower results.

There is also a selection bias. The highest winners over 30 days are promoted, but in crypto, a 30-day profit does not necessarily mean the same results can be replicated. Copy traders need to look at the bigger picture.

Although the aggregate follower PnL across all platforms was +709,000 USDT, those profits were concentrated in a few leaders, with less than 50% of them actually making their followers money.

Binance & Bybit Net-Positive; MEXC Net-Negative in Our 90-Day Sample

The status of the platform used for copy trading affects copy traders’ performance outcomes. From our research, we identified a stark discrepancy. Binance followers had a 66.50% event win rate; 72.45% of Binance leaders delivered positive follower PnL, totaling +572,979.94 USDT. Bybit followers won less often (43.65%) yet still finished net positive at +346,106.01 USDT, with 40.34% of leaders making followers money.

However, in our 90-day dataset, MEXC showed 57.79% copier wins yet a −210,040.51 USDT aggregate follower PnL—consistent with negative expectancy.

Results from all three exchanges are representative of the current 90-day sample only.

How can the win rate be high while investors made less profits?

This outcome arises when average losses exceed average gains, meaning that occasional significant losses outweigh frequent small wins. This pattern may be linked to tight take-profit levels, wide or absent stop-losses and can outweigh emotional decision-making, and high leverage in volatile markets.

In other words, a high win rate does not equal profitability when liquidations and a lack of trading knowledge can erase smaller gains. MEXC’s case highlights how platform-specific trading conditions and behavioral biases can distort overall performance, even in systems designed to automate decision-making.

Evidence Driven Guidance for Copy Traders

Copy trading is not a set-and-forget strategy. Data shows that a large cohort of traders can be profitable in copy trading; however, profitability often correlates with experience and risk discipline, which we did not measure directly.

A 2023 study emphasizes that copy trading enables traders to learn while trading and to follow risk management practices from trading leaders. However, an earlier study from 2018 contradicts the claim, stating that while copy traders have a better learning curve, they are exposed to higher risk-taking. That is due to the lack of understanding of risk management.

In our research phase, we identified instances in which leaders became profitable after a significant drawdown. Data on copy trading also shows that copy traders often prioritize ROI, without considering past performance. As we discovered, 90-day profitability is not always aligned with total profitability reported by leaders due to a limited visibility into certain metrics such as drawdown, average loss. Initial crypto trading platform leaders may not include full risk metrics, which can limit comparability across leaders if not enough research is done. Only after further investigation can copy traders better understand their profitability.

Thus, for less experienced retail copy traders with limited capital and unfamiliarity with trading statistics, they are unable to understand the risks of following a leader with a high 30-day ROI vs reading the complete data.

Risk management, however, is what drives retail traders to deplete their accounts and be part of the 48.48% copy traders who are not profitable. While some systems allow automating trading, others can offer manual trading, and even so, without adequate position sizing and capital allocation, copy traders are on the losing side. More often than not, profitable leaders have more capital to supplement their positions and can withstand larger drawdowns before prices move higher. By contrast, these metrics may not be visibly displayed on public pages, depending on the platform, leaving copy traders with limited capital to be liquidated and unable to remain profitable.

Data Insight and Future Prediction

Using social trading tools, such as copy trading, may suit a specific type of trader. They, however, are not meant for newcomers with limited experience and knowledge. While social trading tools can offer valuable insights and exposure to diverse strategies, they are not designed as shortcuts for beginners. For inexperienced users, following without independently analyzing the underlying rationale often leads to inconsistent outcomes and increased risk.

Copy trading is likely to remain a key feature in the growing investing landscape as it blends automation, transparency, and community-driven learning. However, our research underscores that trading remains difficult, and even top-performing leaders do not achieve a 100% success rate. Thus, success in trading requires a focus on risk management, continuous learning, and capital protection rather than set-and-forget strategies that automate the process.

The findings describe this 90-day sample only and may change with platform methodology. No platform endorsement is implied and this report is not investment advice.